Don’t be fooled by rapid refund loans. With United Way of the Big Bend’s VITA program, you can get your taxes prepared quickly and easily at no cost by an IRS certified volunteer and receive your full refund.

New site information will be added in January 2025

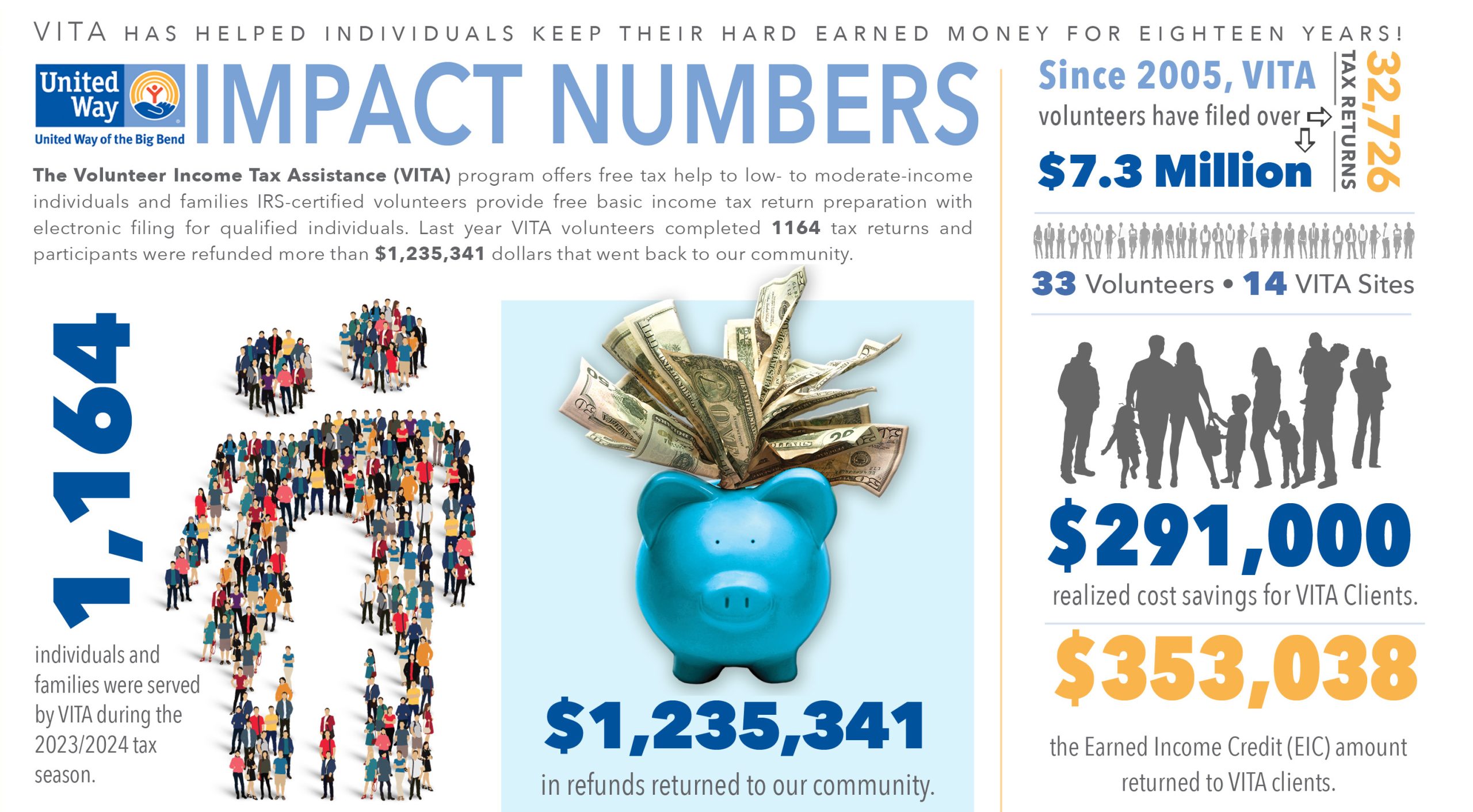

The Volunteer Income Tax Assistance (VITA) program offers free tax help to low- to moderate-income individuals and families. IRS-certified volunteers provide free basic income tax return preparation with electronic filing for qualified individuals.

If you have any questions about a completed return, please contact Samantha Sager, at samantha@uwbb.org or 850-414-0856

We can complete up to three years of past returns. If you have multiple years of tax returns that need to be completed, please make an appointment for each year.

VITA Need-to-Know Information

For more information about VITA please contact Samantha Sager, at samantha@uwbb.org or 850-414-0856

For more information about VITA please contact Samantha Sager, at samantha@uwbb.org or 850-414-0856